Free Business Checking [Maximize Your Savings Today]

Business banking can be overwhelming, but it doesn’t have to be. This article will unlock the secrets to Free Business Checking, detailing its key features, benefits, and top providers. You’ll learn how to open an account, manage it efficiently, and make the most of your banking experience.

Stick around, and we’ll guide you through each step, ensuring you have the knowledge to make informed decisions and keep your business finances on track.

Also Read: 7 Best Construction Factoring Companies [Top Picks!]

When exploring options for Free Business Checking, it’s important to identify key features that will benefit your business. Essential features like no monthly fees, a free debit card, online and mobile banking, and ATM access can make a significant difference in managing your finances efficiently.

One of the standout features of a Free Business Checking account is the absence of monthly fees. This means you can maintain your account without worrying about incurring additional costs each month. For small businesses and startups, avoiding these fees can help in allocating funds to other critical areas.

By not having to pay a monthly fee, you can keep more of your hard-earned money in your business account, ensuring better cash flow and financial health.

A Free Business Checking account often comes with a free debit card, which is an invaluable tool for daily transactions. This card allows you to make purchases, pay bills, and withdraw cash without any extra charges.

Additionally, having a debit card linked to your business account helps in maintaining a clear separation between personal and business finances, which is essential for accurate bookkeeping and tax purposes.

In today’s digital age, online and mobile banking are indispensable features of a Free Business Checking account. These services allow you to access your account anytime, anywhere, making it easier to manage your finances on the go.

Mobile banking takes this a step further by providing the same functionalities through a smartphone app. This means you can handle your banking needs while traveling, attending meetings, or from the comfort of your home.

Having access to ATMs is another significant feature of a Free Business Checking account. This allows you to withdraw cash conveniently without incurring fees, especially if the bank has a wide network of ATMs.

Some accounts even offer rebates on ATM fees charged by other banks, making it easier to access your money wherever you are.

Also Read: 5 Best Free Bookkeeping Software For 2024 [Top 5 Picks You Need to Try]

Choosing the right business checking account is crucial for managing your finances effectively. Here, we’ll dive into some of the top providers offering free business checking.

| Bank Name | Description |

|---|---|

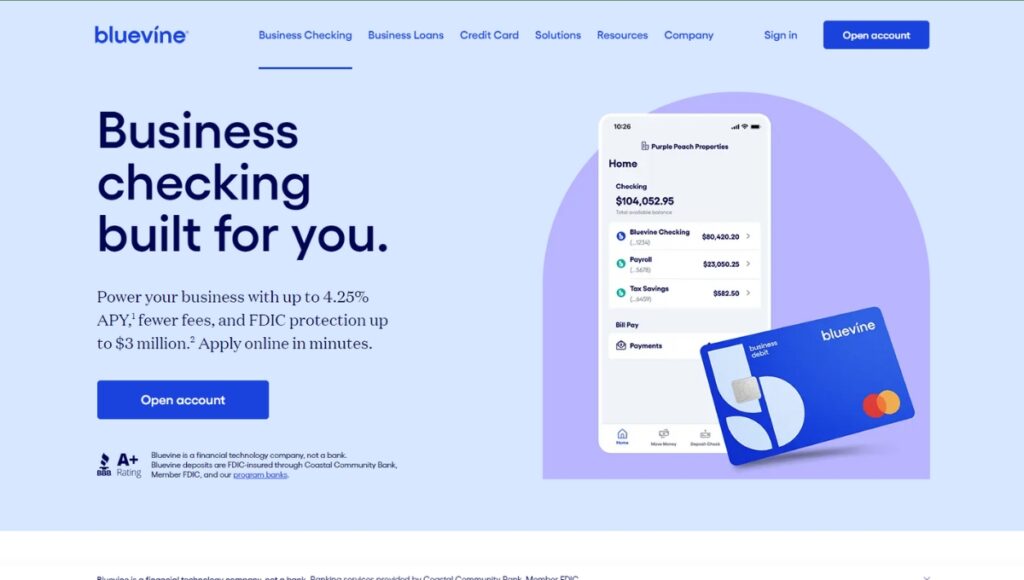

| Bluevine Business Checking | Offers a high APY of up to 2.00% with no monthly fees and unlimited transactions, ideal for small businesses. |

| American Express® Business Checking | Provides flexible banking solutions with no monthly fees and access to a wide range of financial services. |

| Grasshopper Business Checking Account | An online account with unlimited 1% cash back on debit purchases and up to 2.25% APY, but no cash deposit option. |

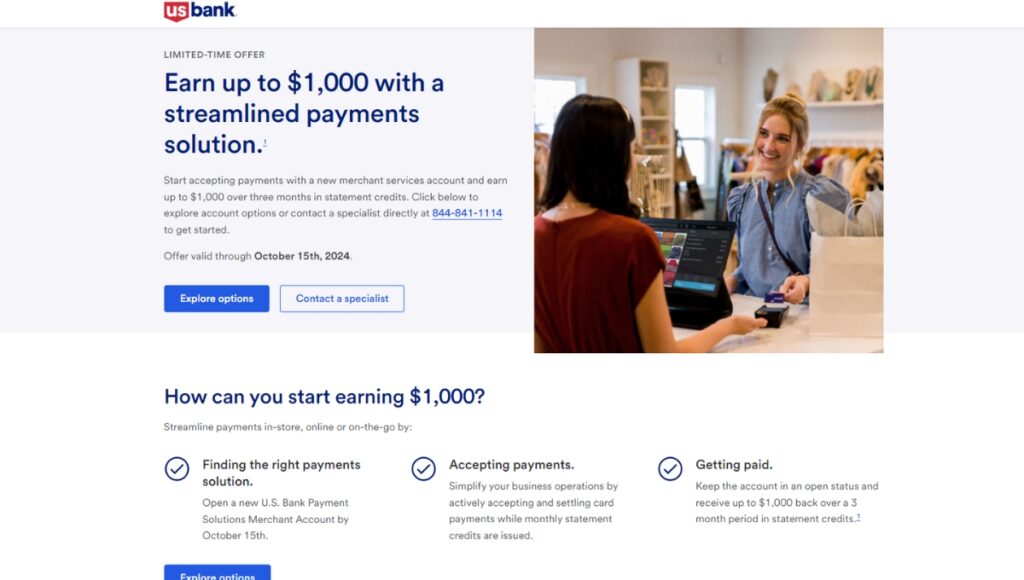

| U.S. Bank Silver Business Checking | A traditional bank account with a low monthly fee, offers essential features for small businesses. |

| nbkc Business Account | Offers a straightforward checking account with no monthly fees and competitive interest rates. |

| Axos Business Checking | Focuses on financial management tools for small businesses, with no monthly fees and multiple sub-accounts. |

| Mercury Business Bank Account | Aimed at startups and tech companies, providing no monthly fees and a modern banking experience. |

| Novo Business Checking | A digital banking solution with no monthly fees, designed for small businesses with easy invoicing features. |

| Lili Basic Business Checking | Aimed at freelancers, offering features like expense tracking and no monthly fees. |

| Navy Federal Credit Union Business Checking | Provides a range of financial services with competitive rates and no monthly fees for eligible members. |

Bluevine Business Checking is a financial technology company that offers a business checking account designed to help small businesses save money, earn interest, and manage their finances more efficiently.

With no monthly fees, high-yield interest, and FDIC insurance up to $3 million, Bluevine aims to provide a convenient and cost-effective banking solution for entrepreneurs and small business owners.

| Pros | Cons |

|---|---|

| No monthly fees or overdraft fees | Charges fees for certain transactions like outgoing wire transfers or international payments. |

| Earn up to 2.0% APY on balances up to $250,000 | Interest rate may be lower than some traditional banks |

| FDIC insurance up to $3 million per depositor | Limited to 5 sub-accounts |

| Convenient mobile app and online banking tools | Customer support may not be as readily available as some traditional banks |

| Debit cards with cash-back rewards |

American Express® Business Checking is a multinational financial services corporation headquartered in New York City. Founded in 1850, it is known for its charge cards, credit cards, and travel-related services.

American Express is recognized for its premium customer service, rewards programs, and a wide range of financial products tailored for both individuals and businesses.

| Pros | Cons |

|---|---|

| Excellent customer service | Annual fees can be high |

| Comprehensive rewards and benefits | Acceptance may be limited in some areas |

| Strong travel perks and insurance | Some cards require good to excellent credit |

| User-friendly mobile app | Foreign transaction fees on some cards |

| Variety of card options for different needs | High interest rates on carried balances |

Grasshopper Business Checking Account is a digital banking platform designed specifically for small businesses, offering a range of financial solutions that combine advanced technology with personalized customer support.

The bank emphasizes a seamless online experience, allowing business owners to manage their finances efficiently without the traditional hassles associated with banking.

| Pros | Cons |

|---|---|

| High interest rates on savings accounts | Limited physical banking options (no cash deposits) |

| No monthly fees or minimum balance requirements | Not available for all business types (e.g., adult entertainment, gambling) |

| Easy online account setup | No support for Zelle integration |

| Robust digital tools for financial management | Initial deposit required to open an account |

| Personalized customer support | Limited to U.S. citizens and residents only |

U.S. Bank Silver Business Checking is a major financial services company that offers a wide range of banking products and services to individuals, businesses, and institutions.

Founded in 1863, it is the fifth-largest commercial bank in the United States, with over $495 billion in assets and a presence in 26 states.

| Pros | Cons |

|---|---|

| Wide range of banking products and services | Maintenance fees for some account types |

| Presence in 26 states across the U.S. | Excess transaction fees for Silver Business Checking |

| No monthly maintenance fee for Silver Business Checking | Limited free cash deposits for Silver Business Checking |

| Helpful tools like the business EZ Switch Kit |

Also Read: Top 7 Best PPC of Agencies to Maximize Conversions Now

nbkc Business Account (National Bank of Kansas City) is a financial institution that provides a variety of banking services tailored to meet the needs of businesses. With a focus on hassle-free banking, NBKC aims to support business growth through innovative financial solutions and personalized customer service.

The bank emphasizes online banking convenience while ensuring that real people are available to assist customers with their banking needs.

| Pros | Cons |

|---|---|

| Competitive fees for business accounts | Limited physical branch locations |

| Comprehensive online banking tools | May not offer as many personal banking services as larger banks |

| Strong customer service and support | Loan approval times may vary |

| Flexible loan options for businesses | Some services may have additional fees |

| Focus on business growth and cash management | Limited national presence compared to larger banks |

Axos Business Checking is a digital bank that offers a range of financial services to individuals and businesses. Founded in 2000, Axos has grown to become one of the largest online banks in the United States, with a focus on providing innovative and convenient banking solutions.

| Pros | Cons |

|---|---|

| No monthly maintenance fees for Basic Business Checking | Limited physical branch locations |

| No transaction fees | May have higher fees for certain services compared to traditional banks |

| ATM fee reimbursements | Newer bank with a shorter history than some competitors |

| Free incoming wires and reimbursed outgoing wires | May not offer the same level of personal service as traditional banks |

| Syncing capabilities for financial management | Primarily an online bank, which may not appeal to all customers |

| Variety of business services, including merchant services and payroll | – |

Also Read: Bench Bookkeeping Service [Top Tips for Managing Finances]

Mercury Business Bank Account is a financial technology company that provides powerful business banking and finance essentials to startups and small businesses. It offers a range of features to streamline financial operations, including bill pay, invoicing, accounting integrations, and more.

Mercury is not a bank itself but partners with FDIC-insured banks to provide banking services to its customers.

| Pros | Cons |

|---|---|

| Streamlined financial operations | Not a bank itself, relies on partner banks |

| Unlimited invoicing | Fees for additional bills and higher-tier plans |

| Integrations with popular accounting software | Limited to startups and small businesses |

| Strong fraud monitoring and security protocols | |

| High FDIC insurance coverage |

Novo Business Checking is an online banking platform designed specifically for small businesses. It aims to simplify financial management by providing a range of features that streamline banking processes, enhance cash flow, and integrate with various business tools.

With a focus on user experience, Novo eliminates traditional banking fees and offers customizable solutions to meet the unique needs of entrepreneurs.

| Pros | Cons |

|---|---|

| No monthly fees or hidden charges | Limited physical branch support |

| Easy-to-use interface | May lack some advanced banking features |

| Fast payment processing with Novo Boost | Primarily focused on small businesses |

| Strong security measures | Customer support may be limited to online |

| Integrates well with popular tools | Not suitable for businesses needing cash deposits or loans |

Lili Basic Business Checking is a financial technology company designed specifically for freelancers and small business owners. It offers a comprehensive suite of tools that integrate banking, accounting, and tax management into a single platform, simplifying financial operations for its users.

Lili’s goal is to empower entrepreneurs by providing them with the resources they need to manage their finances efficiently and effectively.

| Pros | Cons |

|---|---|

| No hidden fees or minimum balance | Limited to freelancers and small businesses |

| Integrated banking and accounting | May lack advanced features for larger businesses |

| High-yield savings account | Some users may prefer traditional banks |

| Automated tax preparation tools | Customer support may vary in response time |

| User-friendly interface | Limited physical branch access |

Lili’s focus on simplifying financial management for small business owners makes it a valuable tool for those looking to streamline their operations and gain better control over their finances.

Navy Federal Credit Union Business Checking (Navy Fed) is a member-owned financial institution that primarily serves members of the military, veterans, and their families.

Established in 1933, it has grown to become the largest credit union in the United States, offering a wide range of financial products and services tailored to the unique needs of its members.

| Pros | Cons |

|---|---|

| Competitive rates on loans and savings | Membership limited to military personnel and their families |

| Strong customer service and support | May have fewer physical branches compared to larger banks |

| Variety of financial products tailored to military needs | Some products may have higher fees compared to traditional banks |

| Access to specialized business services | Eligibility requirements for business accounts can be complex |

Navy Federal Credit Union stands out for its dedication to serving the military community, offering tailored financial solutions that address the unique challenges faced by its members.

Opening a Free Business Checking account can offer numerous advantages to business owners. Here are the key benefits:

Free Business Checking accounts offer a valuable resource for small business owners looking to manage their finances without incurring extra costs. By understanding the key features and benefits, you can make an informed decision that best suits your business needs. Remember, choosing the right account can help streamline your financial operations and support your business growth.

If you’re eager to dive deeper into financial tips and strategies, be sure to explore more of our informative blogs. Happy banking!